by Fernanda Wenzel, Pedro Papini, and Naira Hofmeister / Mongabay

Banner image of a farm surrounded by smoke from burning in the municipality of Novo Progresso, Pará estate. Image by Marcio Isensee e Sá.

Wall Street fund manager BlackRock administers 2.2 billion reais ($408 million) in shares in the three largest Brazilian meatpackers operating in the Amazon today. The cattle purchase and slaughter operations of JBS, Marfrig and Minerva involve 6.9 million hectares (17 million acres) of land at high risk of deforestation. That puts BlackRock’s investments at odds with its own public rhetoric of recent years, in which it has positioned itself as leading the financial industry’s prioritization of environmental, social and governance (ESG) criteria when deciding where to invest a client’s money.

Most of its investment in the Brazilian meatpackers — 1.8 billion reais, or $334 million — is in JBS, the world’s biggest meat producer. JBS is also the company most exposed to Amazon deforestation, according to the conservation nonprofit Imazon. In July, an Amnesty International report said JBS was slaughtering cattle that originated from illegal farms located in conservation areas and Indigenous lands. BlackRock also has 213 million reais ($39.5 million) invested in Marfrig and 131 million ($24.3 million) in Minerva, who rank fifth and 10th, respectively, on Imazon’s ranking of deforestation risk. Independent investigations also show that these companies have indirect suppliers that raise cattle illegally in the rainforest.

This investigation by ((o))eco looked at the content of 953 stock funds managed by BlackRock, 24 of which hold shares in the Brazilian meatpackers. BlackRock confirmed the data to ((o))eco; the values are given in the local currency, with the dollar figures based on the exchange rate on Aug. 18.

In January this year, BlackRock CEO Larry Fink published an open letter in which he announced measures to “position sustainability at the heart of investment strategy” of the company, the world’s biggest money manager.

This vision, applied to its investments in the Brazilian meatpackers, could make BlackRock the driving force in holding the biggest companies in the beef industry to their promise of exclusively offering zero-deforestation meat. That commitment stems from 2009, but none of the companies has fulfilled it yet. The issue resurfaced in July, when the companies began to come under pressure from their international investors who didn’t want to be associated with the fires and deforestation razing the Amazon rainforest.

“BlackRock is the global leader in asset management, so its actions have significant effect on the entire sector,” says Moira Birss, director of climate and finance at Amazon Watch. “Yet it appears that the company hopes people don’t look closely at investment data and only look at the headlines, which look great.”

Amazon Watch in 2018 launched a campaign accusing BlackRock of being the world’s “greatest causer of climate chaos.” According to the NGO, BlackRock is among the main shareholders in 25 of the largest open capital companies in the world associated with deforestation in tropical rainforests in Latin America, Africa and Southeast Asia.

Blame it on the ETFs

Of BlackRock’s investment in the three Brazilian meat packers, 1.8 billion reais is considered “passive investment,” where the fund portfolio mirrors a benchmark basket of shares, and the fund manager doesn’t interfere in the proportion of shares held within the portfolio. These are known as exchange-traded funds (ETFs), and BlackRock’s iShares family of ETFs account for two-fifths of the global ETF market share. “It is important to observe that over 90% of BlackRock’s patrimonial assets under management are in funds that track third party indices,” the company said in a statement. Read BlackRock’s full response here.

The 953 iShares that the ((o))eco report analyzed are all ETFs. The idea behind them is that because they replicate reference indexes in terms of their makeup, such as the local stock exchange, they can serve as a helpful guide for investors. In practice, the system leaves room for distortion and greenwashing, as ((o))eco showed in July.

Because ETFs mirror the list and proportion of shares tracked in the reference indexes, the fund managers can’t use their discretion to add or remove companies from the fund, or increase or decrease investments in individual companies. And this gives BlackRock grounds for maintaining these investments. One example is the iShares MSCI Brazil ETF, a fund that replicates Morgan Stanley’s MSCI Brazil index, and through which BlackRock manages nearly 500 million reais ($92 million) in JBS shares. The ETF also includes 56 other Brazilian companies whose stock price would be affected if BlackRock were to close the fund.

Yet even as it maintains stakes in the meatpackers through these passive funds, BlackRock is promising that, by the end of the year, its entire active portfolio will be guided by environmental and social criteria; at present about 70% of these funds comply with its ESG criteria.

BlackRock says it discloses the content of these portfolios according to the “regulations of the markets in which it operates.” In the U.S., for example, it’s required to publish every six months and annual reports with open content on investments so the public can verify its contents. However, in disclosure documents for its products in 34 other countries, we were unable to access complete information about actively managed portfolios. Obtaining these data requires a search on the sites of the agencies that regulate the respective markets, which is not always a straightforward task for many retail investors.

In addition, some countries don’t require full portfolio transparency, but only disclosure of the 10 main assets in each portfolio. In situations like this, “the asset manager itself can decide how much it wishes to divulge,” says Ward Warmerdam, a senior researcher at Profundo, a Netherlands-based organization that advocates for greater transparency in investments. “In Norway, for example, some fund managers divulge completely and some only divulge the 10 main investments,” he says.

Actively managed portfolios account for just 27% of BlackRock’s total investments: 65% are in passive funds — including the ETFs through which the company continues to invest in the Brazilian meatpackers. An illustration of why this makes it difficult to square BlackRock’s sustainability rhetoric with its actions is CEO Larry Fink’s vow to divest from “producers of charcoal for thermoelectric plants.” Despite the hubbub this raised in the press and on the financial markets, BlackRock’s new stance meant dropping just 20% of such assets, according to Amazon Watch, frustrating those hoping for a more meaningful outcome.

“In truth, BlackRock committed to letting go of shares in coal companies only among its active administration funds, which are a small portion of its business,” says Birss from Amazon Watch. “Plus, there are many limitations on the amount or type of coal to be avoided. This is of course important, but it is a very small amount considering the scale of the climate crisis.”

No. 3 shareholder in JBS

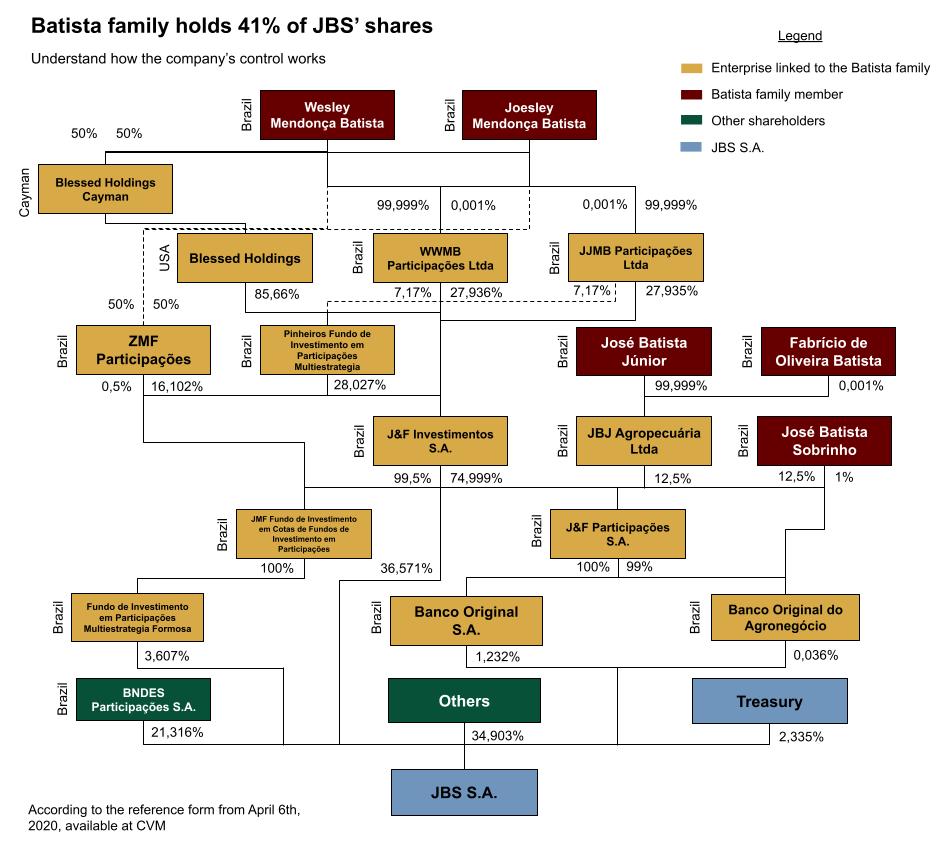

BlackRock’s holding in JBS, even via ETFs, make it the company’s third-largest shareholder, behind only the Brazilian Development Bank (BNDES) and the Batista family that founded the company. This is according to a study by Forests and Finance, a coalition of six NGOs that monitors the participation of the international financial institutions in environmentally risky activities.

Even so, Forests and Finance didn’t manage to fully trace BlackRock’s entire stake in JBS, which it put at 1.3 billion reais ($240 million); BlackRock itself told ((o))eco its investments in the meatpacker amount to 1.8 billion reais. “The financial sector is notorious for its lack of transparency and for creating structures inside which it is nearly impossible to track the [company] owners,” says Merel van der Mark, coordinator of Forests and Finance. “But we do our best to track as much shareholder participation as possible.”

With at least a 2% stake in JBS, BlackRock has the power to vote on company decisions, even though its direct influence would be reduced. Beef industry shareholder structure puts more power in the hands of company owners, limiting the capacity of minority shareholders like BlackRock to influence company conduct, BlackRock says.

This is why BlackRock says it will look to institutional dialogue to promote change in environmental and social policy. According to its press office, it has promoted meetings between five agribusiness companies operating in Brazil — JBS, Marfrig, Minerva and commodities traders Bunge and ADM — “to discuss their policies and practices on specific issues around operating inside the Amazon Basin like land use and supply chain management.”

$90 million in active investments

Forests and Finance has also identified the amount of debt securities BlackRock has purchased from the Brazilian meatpackers, totaling 64.5 million reais ($11.9 million): 24 million reais ($4.4 million) from JBS, 22 million reais ($4.1 million) from Marfrig, and 18 million reais ($3.3 million) from Minerva. Forests and Finance calculated the proportion of the debt purchase that goes directly into funding activities related to cattle farming; the total value of debt that BlackRock bought from the meatpackers is more than double, at 134.2 million reais ($24.8 million).

In addition, BlackRock reports its actively managed investments in the meatpackers is valued at 352 million reais ($65 million). That puts the total value of direct investment that the manager maintains in this industry most closely associated with deforestation in the Amazon at 486 million reais ($89.7 million). This is the sum that BlackRock actively chooses to invest in the companies, even after risk analysis for the industry’s environmental exposure. Unlike the passive investments, this represents equity and debt that the fund manager could give up without compromising other companies.

Here, again, the main destination for BlackRock’s active investments is JBS. Its direct investment alone, at 327 million reais ($60.4 million), is greater than the amount divested from the meatpacker by Finnish bank Nordea in July, following a recent slate of problems such as illegally raised cattle, corruption, and COVID-19 outbreaks at its plants in Brazil and the U.S. “JBS was by far the most problematic of the Brazilian meatpackers,” Eric Pedersen, head of responsible investments at Nordea, told ((o))eco.

The divestment hit headlines around the world, including in The Guardian and news agencies Bloomberg and Reuters. For the first time, the planet’s largest beef company, with the greatest number of plants in the Amazon — 31, according to Imazon’s most recent and as-yet-unpublished study — was seen as having a have real effect because of deforestation.

Dumping so much stock at once did not have the expected impact of jolting JBS’s share price. Instead, the impact was minimal. At the start of July, before Nordea’s selloff, JBS shares were trading at 20.89 reais; they reached 22.95 on July 7, before ending the month with a net increase at 21.54.

This wasn’t the first time a divestment motivated by environmental issues failed to achieve practical results. In the third quarter of last year, investment manager Storebrand divested from Marfrig, according to its CEO, Jan Erik Saugestad, in a statement to ((o))eco in July. However, during the period in which Storebrand sold its shares, Marfrig’s stock price increased by 70%, 6.48 reais in July to 11.02 in September.

The sheer volume of BlackRock’s holdings in JBS could make a difference, says Luiz Macahyba, consultant and partner at Aondê-Consultoria Econômica. The size of investment companies counts in cases like this: BlackRock operates in 36 countries and has clients in more than 100, and has at least 193 direct and indirect subsidiaries around the world, two of them in Brazil. According to its most recent quarterly report released in July, the company has $7.32 trillion in funds under management — a sum five times Brazil’s 2019 GDP.

“It’s one thing for Nordea to announce that it’s divesting from JBS, and another thing for BlackRock, the world’s largest financial asset manager, to make that announcement,” Macahyba says. “This could affect investor expectations regarding future profitability of the group.”

BlackRock appears to have reduced its stake in JBS since the beginning of the year by 17.4% as of August, according to data from Forests and Finance.

But just as with Storebrand’s divestment from Marfrig and Nordea’s from JBS, this selloff has had no impact on JBS’s share performance on the stock market. “They are probably sales made separately and on different days. This is why it had no effect on price,” Macahyba says.

Such trades are also carried out under great discretion to avoid investor loss. A divestment is only announced after the sale of shares is complete, even if the divestment symbolizes a public criticism by the financial firm of the company and places its credibility on the market in question.

An analogy is a homeowner selling an apartment because an enormous leak is damaging the property’s entire structure, but omitting to mention the problem when closing the deal. In this case, BackRock appears to have sold first and explained later, attributing its decision to JBS’s association with deforestation and corruption.

“These financial groups are in fact progressively engaged in environmental issues, but nobody tears up money,” Macahyba says. “If the fund manager sells everything at once, he’ll suffer great loss. So he sells the shares in small parcels and later announces the total selloff to gain political impact with his decision.”

Profit amid forest fires

The gradual divestments did not impact the share price, nor did they frustrate the optimistic mood presiding over JBS’s unveiling of its second-quarter results.

The investor pressure was quickly forgotten, obscured by the net profit of 3.4 billion ($626 million) — a 54.8% leap from the same quarter last year.

“Congratulations on the spectacular results! Fantastic!” one of the investors declared at the Aug. 14 event. “Really impressive,” said another. The online presentation was led by JBS’s top executives, including global CEO Gilberto Tomazoni and Wesley Batista Filho, CEO of JBS Brasil.

One participant asked the executives if it weren’t better to close all the plants in the Amazon “given this negative bias coming from the press, to which everyone is paying more attention.” The issue gained urgency at the end of June, when a meeting of President Jair Bolsonaro’s administration became public. In that meeting, Environment Minister Ricardo Salles suggested taking advantage of the “opportunity” provided by the media and public focus on the coronavirus pandemic — which killed more than 100,000 people in Brazil — to “pull a fast one” and deregulate environmental norms.

According to the JBS executives, the company’s presence in the Amazon is not the problem, but rather “part of the solution.” “Our operations can safely bring improvements and positive change to the region,” Wesley Batista Filho said. He even indicated that a platform to control the entire productive chain in the Amazon is in a “very advanced” stage of development, but gave no forecast for the start of indirect supplier tracking, and none of the investors raised any questions about the lack of a deadline.

Marfrig’s second-quarter results, released on Aug. 12, also showed no detrimental impact from recent pressure from international investors against deforestation. Rather, the company had “the best result in its history, with net profit of 1.6 billion [$295 million].” That’s an increase of 1,743% from the same quarter last year.

Minerva’s shareholders and partners also have reason to celebrate. Last quarter, the company achieved net profit of 253.4 million ($46.7 million), its best second quarter ever.

The replacement of forest by pasture is one of the main causes of deforestation in the Amazon biome. There is a lack of control in the supply chain to ensure that deforestation is not associated with meat production. Image by Marcio Isensee e Sá.

‘It’s the contamination effect’

While JBS, Marfrig and Minerva go unscathed from the effects of deforestation, other sectors of the Brazilian economy are wary that the rainforest fire crisis will have a negative effect on their businesses, even if their operations are located far from the rainforest. At the start of July, leaders of 38 large companies and four trade associations sent a letter to Vice President Hamilton Mourão, warning that the country’s negative image overseas “has a potentially damaging effect on Brazil, not only from the reputational point of view, but effectively for the development of business and projects that are fundamental for the country.”

The movement has grown, and the letter now has 72 signatories, according to the Brazilian Business Council for Sustainable Development (CEBDS), which is leading the initiative. Among those that signed are pulp and paper manufacturer Suzano, whose chief financial officer, Marcelo Bacci, has spoken of taking a map to meetings with foreigners to convince them that the company’s production units are located far from the Amazon.

“Pretty soon, we will see companies in the Pampa in Rio Grande do Sul [the southernmost state of Brazil] being impacted by what goes on in the Amazon,” says Robson Dias da Silva, a professor of economics at Rio de Janeiro Federal University (UFRRJ). “It’s the contamination effect,” he says, adding that those depending on foreign investment could have a harder time getting funding, or have to pay higher interest on loans.

Cole Martin, senior agribusiness analyst at Fitch Solutions, says efforts like Suzano’s map and product tracking may not be enough to prevent Brazilian exporters taking a hit. “For companies that import, it could be hard to track and verify what is legal and what is not, especially the indirect suppliers,” he says. “Instead of running the risk of purchasing something that has to do with deforestation and create a problem for the company, over time it will probably be easier for them to simply establish that they don’t buy anything from Brazil.”

The concern over this “contamination effect” also led the president of the Brazilian Agribusiness Association (ABAG) to sign the letter. In a press conference on Aug. 12, Marcello Brito called for the federal government to set a clear target for reducing deforestation. He also took a swipe at declarations made by President Bolsonaro, for whom the international pressure to preserve the rainforest is cloaked in business interests.

“We need to dig in and be more mature when discussing these issues because business interests will always stand firm,” Brito said. “The most important thing is to identify the collective conscience that evolves quickly — that’s what we need to touch on. It will be the collective actions of environmental and socially sustainable production that will fill in this future business space against any geopolitical barrier.”

Also in July, another initiative showed that deforestation is a problem that has expanded beyond the radar of environmentalists and now concerns economists. Twelve former finance ministers and five former central bank presidents signed a letter advising the government to set a path toward a low-carbon economy. The signatories include a broad spectrum of political figures, including former president Fernando Henrique Cardoso (from the PSDB party), Pedro Malan, who was the finance minister in the administration of Fernando Collor (PROS), and Nelson Barbosa, who headed planning for the administration of Dilma Rousseff (PT).

The Ministry of the Economy, headed by Paulo Guedes, said in an email to ((o))eco that “it is undeniable that illegal deforestation in the Amazon immensely harms the Brazilian economy and population” and that “even though illegal deforestation is an historical problem, today we have a national image problem that we know the government had the responsibility to address.” See the ministry’s full response here.

“A warning light came on because the topic migrated from the Ministry of the Environment to the Ministry of the Economy,” says Silva, the economics professor. “Soon, Avenida Paulista [Brazil’s Wall Street] will start to have trouble raising capital because the Brazilian seal has been burned.”

European trade deal in doubt

The most glaring economic impact for now is the possible failure of the trade agreement between the European Union and the South America trade bloc Mercosul (Mercosur in Spanish). The accord was signed in June 2019 following 20 years of negotiations, and in order for it to come into effect, it must be ratified by all member countries. But citing increased deforestation in the Amazon, the Netherlands parliament has rejected the accord, and legislative bodies in Ireland, France and Belgium have already sent out signals along the same lines.

On Aug. 21, German Chancellor Angela Merkel said she has “serious doubts” about the implementation of the accord due to increased deforestation in the Amazon. Her statement came after a meeting with Swedish environmental activist Greta Thunberg.

According to the German Embassy in Brazil, “information about increased deforestation could have a negative impact on public opinion in other members of the European Union as well as the desire of many parliament members to ratify this accord.” The Brazilian Ministry of the Economy said the “possible concerns” on the environment will be dealt with under the agreement and that not internalizing it “is to undermine these institutional advances and … the environmental agenda of bilateral interest.”

Martin from Fitch Solutions puts it more plainly: “The agreement between the EU and Mercosul is dead for the moment.” Based in London, Martin says he is closely following the launch of the European Green Deal, an economic pact on environmentally sustainable created to stimulate the post-pandemic economy. Among the many measures laid out for the coming years — such as an expansion of environmentally protected areas, reduced pesticide use, and lower meat consumption — is a proposal to keep products associated with deforestation off the European market.

This report is the fifth in a series investigating the relationship between the financial market and the Brazilian beef industry. If you would like to contact the newsroom with a suggestion for further reporting, write to: quemfinanciaodesmatamento@gmail.com.

This story was originally published in Portuguese by ((o))eco.

Please provide dates for your articles. Thank you!